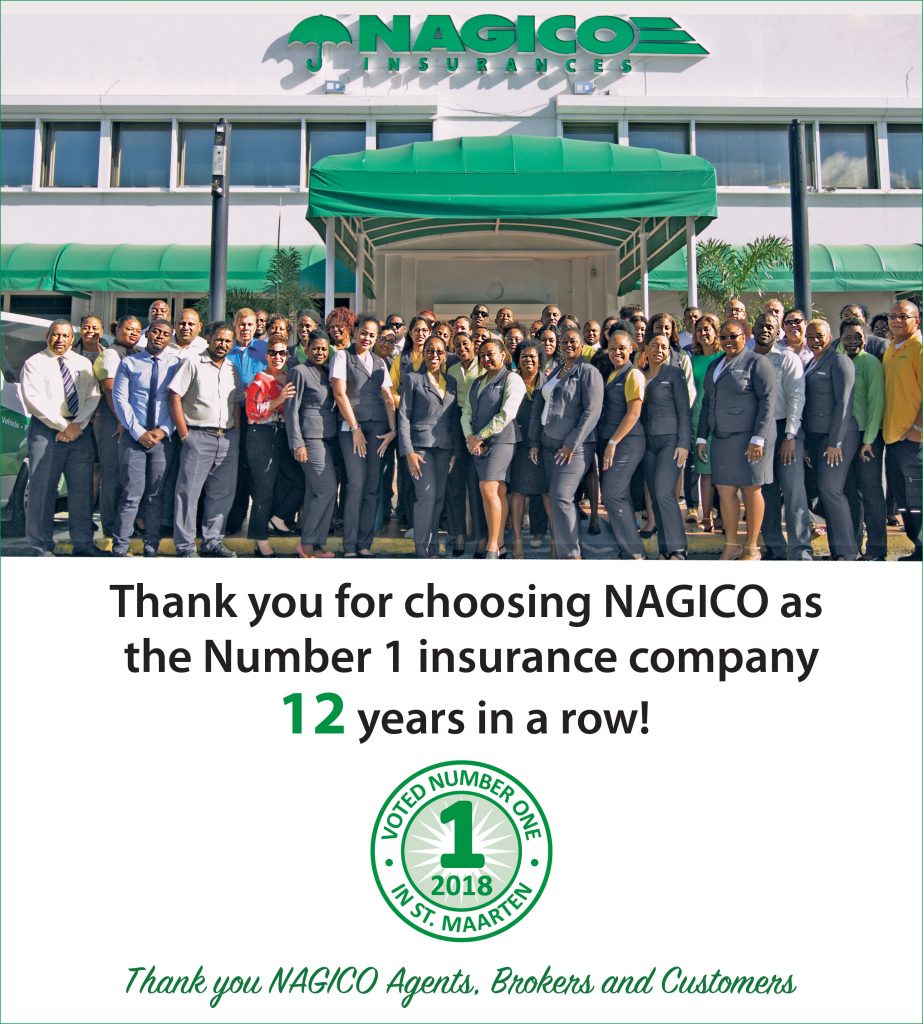

NAGICO’s leadership in catastrophe claims management affirmed as voted #1 insurance company for the 12th year in a row in St. Maarten.

Philipsburg, Sint Maarten – February 7, 2019 – NAGICO Insurances, a diversified insurance group serving 21 territories in the Caribbean, is proud to announce that it’s Long-Term Issuer Credit Rating has been upgraded to bbb+ by A.M. Best.

A.M. Best’s Rating Services evaluated both the financial and non-financial risks within NAGICO’s business and in its press release earlier today, A.M. Best stated that, “the ratings of NAGICO Group reflect its balance sheet strength, which A.M. Best categorizes as very strong, as well as its adequate operating performance, neutral business profile and appropriate enterprise risk management.” As it relates to the Group’s financial strength, A.M. Best stated “The very strong balance sheet strength assessment is based on supportive risk-adjusted capitalization, as measured by Best’s Capital Adequacy Ratio, which is at the strongest level following a quick recovery from the impact of hurricanes Irma and Maria in 2017.”

“We are very proud to have earned this upgrade from A.M. Best. The upgrade signifies the agency’s recognition of our ability to effectively manage and withstand the worst of catastrophes and reflects their confidence in our management team, operations, financial strength and stability,” NAGICO Chairman Imran McSood Amjad said.

Further affirming NAGICO’s leadership in catastrophe management and service, NAGICO was voted the #1 insurance company for the 12th year in a row in St. Maarten, based on a survey conducted by St. Maarten-based newspaper The Daily Herald, a leading daily newspaper serving St. Maarten and the Northeast Caribbean.

“The customer experience and our ability to deliver on our promises are of paramount importance to us. Our team worked passionately and tirelessly to serve our clients after the hurricanes devastated the islands in 2017, so it was very humbling and heartwarming to be awarded Best Insurer in St. Maarten by the public as it reflected the level of appreciation of our efforts.” said Detlef Hooyboer, NAGICO’s Chief Executive Officer. “We believe that the rating upgrade from A.M. Best coupled with the Best Insurer title in St. Maarten is very much aligned with our core values: Strength, Stability and Service.” More information on the rating can be viewed at www.ambest.com.

A.M. Best is the world’s oldest and most authoritative insurance rating and information source. For more information, visit www.ambest.com.

About NAGICO Group

The NAGICO Group was established in 1982 and is well established across 21 territories in the Caribbean, providing property and casualty insurance, life and health insurance and risk solutions to customers. To learn more about NAGICO, visit www.nagico.com.

You can find the full press release published by AM Best here

Click here to

Click here to  Founded in 1982, The NAGICO Group has grown strategically and organically throughout the Caribbean where it now operates within 21 territories. The company offers a family of property and casualty insurance – Property, Motor, Marine, Liability – as well as life & health products and risk solutions. NAGICO’s promise and commitment from day one has been to deliver fast and fair service to its customers and to always be there for them; a promise it delivered on historically, most recently after Hurricanes Irma and Maria and continues to keep daily. 13 of the islands within which NAGICO operates were impacted by the hurricanes and NAGICO has paid nearly ¾ billion USD in the Caribbean region to date, significantly contributing to the rebuilding process. NAGICO also continues to empower communities through corporate sponsorships. NAGICO is a caring, financially strong, reliable and resilient group.

Founded in 1982, The NAGICO Group has grown strategically and organically throughout the Caribbean where it now operates within 21 territories. The company offers a family of property and casualty insurance – Property, Motor, Marine, Liability – as well as life & health products and risk solutions. NAGICO’s promise and commitment from day one has been to deliver fast and fair service to its customers and to always be there for them; a promise it delivered on historically, most recently after Hurricanes Irma and Maria and continues to keep daily. 13 of the islands within which NAGICO operates were impacted by the hurricanes and NAGICO has paid nearly ¾ billion USD in the Caribbean region to date, significantly contributing to the rebuilding process. NAGICO also continues to empower communities through corporate sponsorships. NAGICO is a caring, financially strong, reliable and resilient group.

Philipsburg, Sint Maarten – October 23, 2018 — National General Insurance Corporation (NAGICO), a diversified insurance company serving 21 territories in the Caribbean, has joined the Carnegie Council in celebrating Global Ethics Day 2018 on October 17th, 2018.

Philipsburg, Sint Maarten – October 23, 2018 — National General Insurance Corporation (NAGICO), a diversified insurance company serving 21 territories in the Caribbean, has joined the Carnegie Council in celebrating Global Ethics Day 2018 on October 17th, 2018.