Strong corporate governance, risk management, and compliance (GRC) practices remain important in the insurance industry. There is no shortage of risks in this world and thus laws, regulations and best practices continue to evolve. It is key therefore that our business does so too. Below, we outline the key initiatives and developments that have steered our GRC initiatives in 2024, highlight emerging risks, celebrate important compliance milestones, and present performance metrics that reflect the Group’s progress.

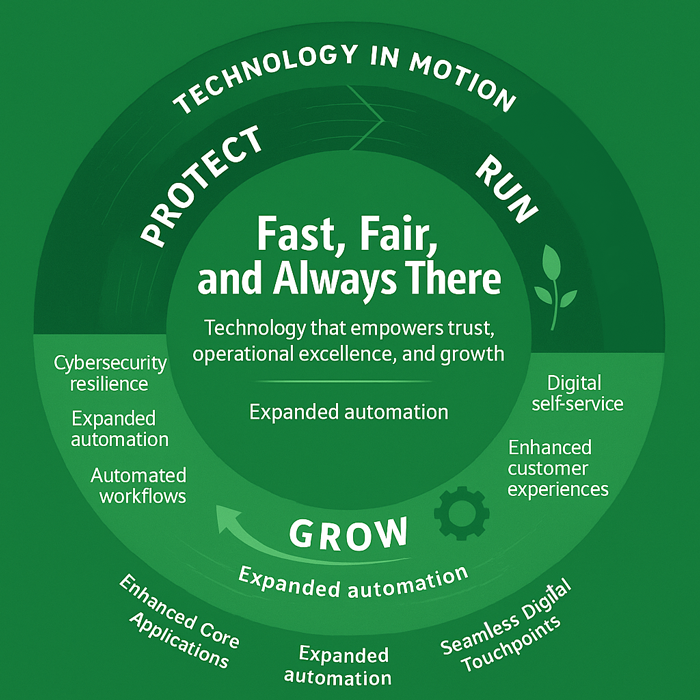

We have seen cybersecurity threats continue to rise globally. With growing digitalization, phishing and ransomware remain a concern. In response, NAGICO has strengthened its cyber resilience strategy, focusing on endpoint protection, employee training and awareness, and rigorous incident response testing to safeguard stakeholder data. This awareness allows our employees to understand and practice safe behaviors related to information security, thereby ensuring that their knowledge, attitudes, and behaviors are geared towards protecting organizational systems, data, and technology from cybersecurity threats.

The Digital Operational Resilience Act (DORA) is reshaping cybersecurity practices, particularly in relation to third-party risk management. We have worked closely with our IT Department and the operations to reinforce operational resilience and proactively mitigate vulnerabilities. Deliverables with respect to the DORA regulations are submitted to our regulatory authorities in a timely manner to evidence compliance with the legislative requirements, and we are better positioned to ensure business continuity in the event of a potential disaster within the Group.

There is a lot of uncertainty around climate change, but one thing for certain is that it is real and it is pertinent to all economies. This is a topic that is on the mind of various stakeholders, including regulators, and new guidance is being developed by some in our region in this area as climate change poses material financial, economic and systemic risks. With extensive regional experience, our Group is uniquely positioned to work alongside regulators in reviewing and shaping proposed guidelines, helping to establish forward-looking frameworks that enhance resilience, support sustainability, and strengthen the region’s long-term stability.

The word tariff has been ringing in everyone’s ears with its reach having a bearing and impact on our business. Tariff uncertainty remains a risk to both our loss cost trends and operational expenses. To ensure robustness in pricing adequacy and claims reserve sufficiency, the Group has begun stress-testing its underwriting portfolios against scenarios of input cost inflation. We continue to monitor these developments closely and will adjust pricing and risk selection as needed to preserve underwriting discipline and profitability across all lines.

The Group’s strong performance in Governance, Risk, and Compliance reflects a shared commitment across all levels of the organization. Enterprise Risk Management continues to be embraced as everyone’s responsibility, supported by training on a range of GRC topics for staff, management, and the Board. Business intelligence dashboards and reports are fully integrated into decision-making, performance monitoring, KPI management, and accountability through task trackers and assignments. Regular stress testing, combined with close monitoring of external developments such as news, market movements, and emerging trends, ensure risks are identified and managed effectively.

The Group’s Internal Audit Department (IAD) also has a role to play in ensuring robust governance and operational effectiveness across the organization. As an independent service function, IAD evaluates management’s understanding of internal controls and assesses their effectiveness, providing assurance that key processes are operating as intended. In addition, the department supports a more efficient external audit by performing work that external auditors can rely on for specific areas, reducing duplication and streamlining audit processes. When IAD’s activities are strategically aligned with the Group’s objectives and focused on the areas of greatest impact, the organization achieves the maximum value from its audit resources. By combining assurance, advisory support, and alignment with strategic goals, the department can not only safeguard the integrity of operations but also contribute to continuous improvement and value creation across the Group.